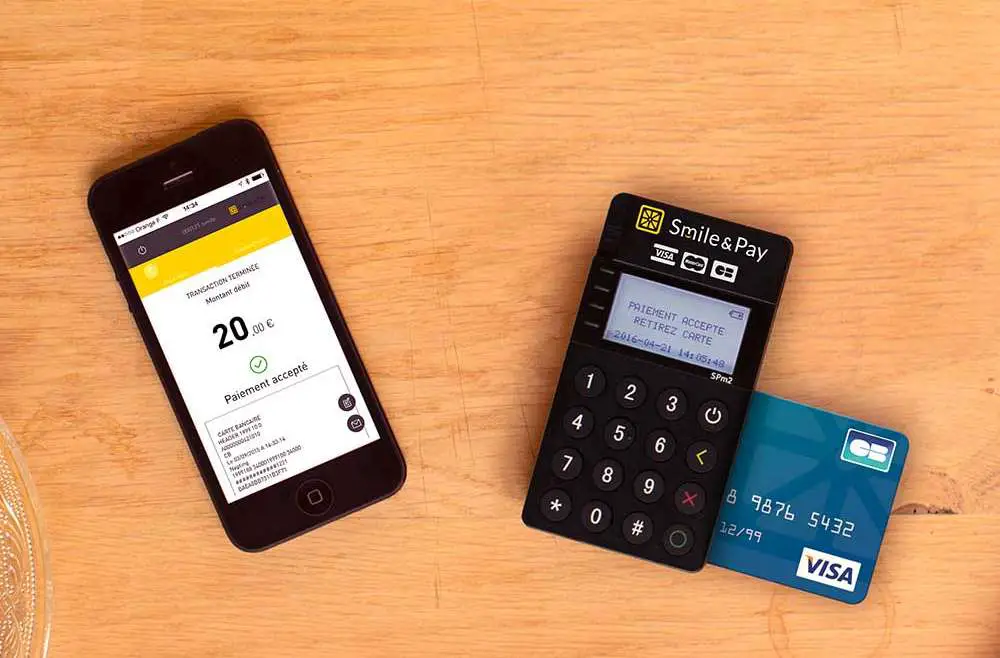

Smile and Pay is a solution used by merchants to cash in money. Unlike other competitors like iZettle, SumUp and myPOS, Smile and Pay is a French 100 company.

The use of this case is not complicated, the mode of operation is simple. The strengths of this company are multiple: no commitment, no monthly fees, a declining rate, many accepted bank cards, contactless mode is present, etc.

The Smile and Pay solution is attractive for entrepreneurs who don't have big turnovers and want to cash in easily and simply. We think of the people who work in the restaurant industry, who are craftsmen, who work in beauty salons…

In this article, we will introduce you to the two payment terminals and how they work.

Introducing the tool

Smile and Pay has implemented two electronic payment terminals that are efficient. We're going to find the PocketSmile and the MaxiSmile.

The PocketSmile is the device that requires the use of a smartphone or tablet to function properly.

The MaxiSmile is self-contained and can work with the WiFi or 3G network thanks to the SIM card that is pre-installed when purchasing the device. It should be noted, however, that there is no data charge to use the MaxiSmile. However, when compared to the competition, this mobile payment terminal is complete and a bit expensive. It's available at 299 degrees. The MaxiSmile has a big advantage unlike other products: it has a printer that is integrated into the credit card reader. Physically, it looks like a classic payment terminal as you can find in the banks…

Whether you choose one or the other, we'll show you how to make the credit card reader work.

How does Smile and Pay work? – Start-up guide

To end up with a functional tool, you have to follow certain steps, very simple and easy to set up.

The process is much the same with other competing companies. You have to create an account to buy the payment terminal. For models that are dependent on a Bluetooth connection with smartphones, you will have to link the two elements, and then you will be explained how the procedure for cashing in and transferring that money to your account Bank.

Three classic and relatively simple steps. We'll go into detail.

How do I create an account?

This step should not exceed 10 minutes. It will take less time if you prepare all the information Smile and Pay needs to validate your account.

Creating an account is mandatory. It allows you to order a payment terminal, but also to connect to the mobile app and web interface to access the “my account” Smile and Pay space. This is where you can manage a number of things and set up your TPE the way you want it.

To register, just go to this link. It can be accessed from a computer, mobile phone or tablet.

For this step, several data are required such as an email address, a mobile phone, a SIRET number, an ID (think the scanner, that's a plus) currently valid and a bank card.

When we signed up for the Smile and Pay test, we were not disturbed by the process. The steps are clear and precise and above all, it is difficult to get it wrong.

Once your registration is completed, you will be able to order your payment terminal. This is the time to choose between the PocketSmile and the MaxiSmile, which cost, respectively, 79 and 299 ht. Delivery times are respectable with an average of 48 hours.

How do I connect with the smartphone?

If you've selected the PocketSmile, you'll need to connect it to your phone. Handling is not complicated. Beforehand, the Bluetooth connection must be enabled on the smartphone. This action is relatively fast, since it did not take us more than a minute.

The first step is to turn on the card reader. It is located at the top right and has the classic logo of an ON/OFF button. He's to the right of the number “3.”

The second step is to enter the TPE settings. To do this, you have to navigate the menus. The use of the yellow “Navigation” button (just below the ON/OFF button) is required. Scroll through the menu until you come across the part we're interested in: “DON'T ACARRIER OF THE DATA.”

In a third step,you will have to press the green button (a round, located at the bottom right of the digital pad) that will activate the Bluetooth of the device.

After that, you'll have to go to your device's Bluetooth settings (the system works just as well with an Apple device (smartphone and tablet) as well as an Android device (smartphone and tablet). If everything works well, i.e. the PocketSmile bank card reader from Smile and Pay has Bluetooth enabled, you'll need to detect it. The name is specific to each device. It comes in the form of “Reader” where the numbers are unique. To make sure it's the right numbers, you'll need to find them on the back of the PocketSmile.

It's time to confirm the connection between the smartphone (or tablet) and the PocketSmile! The connection must be validated by pressing the green button on the drive. You will be asked for a code. You'll find it on the smartphone screen. They will have to be informed and then validated by pressing the same green button.

To reassure you, a message will arrive and inform you of a successful connection! Now your device is ready for use.

The MaxiSmile doesn't need to be connected to a smartphone to work. You'll have to choose the mode of communication you like between WiFi and 3G. You will have a small user guide that will be present in the box to explain the steps to follow, but they are not complicated. You have to choose the network mode (Wifi or 3G) in the settings, log into your Smile and Pay account and the device is ready to use!

Payments with this TPE

To activate payments with the PocketSmile, you will need to download the Smile and Pay app, which is available on the App Store (iOS) and the Play Store (Android).

To log in, you'll need a customer number that's in a Smile and Pay email. The PIN was sent to you by SMS as well. It's a four-digit code that you'll haveto memorize.

Subsequently, the amount of the transaction will have to be captured, making sure to pay attention to the decimals for the pennies. Tap on “Payment by card.” Then cash in the customer. The great thing about Smile and Pay is that you'll have all the information you see on the card reader (for the customer) and the app (for you).

Finally, you have to send a receipt ticket. With the PocketSmile, it is not possible to print it. The shipment should only be done by email or SMS. It's up to you!

The use of the application remains relatively simple.

Payments with the MaxiSmile are disconcertingly easy! This is to insert the amount of the transaction, accept the bank cards and the receipt will be automatically printed.

Using the mobile app

This is not the best application on the market. It is simple and has two basic functions. We'd like more features, but that should happen in the future.

At present, it is possible to collect a sum of money (but no products or catalogues, are present) and to consult the history of the receipts. It's still pretty vague. The lack of a catalogue is unfortunate for small traders who choose the PocketSmile TPE.

The means of payment accepted and authorized by Smile and Pay

A large majority of bank cards are accepted, but this is not the most comprehensive offer on the market. VISA bank cards and MasterCard cards are accepted. Other credit and debit cards are also taken into account. On the other hand, no foreign card is accepted according to the manufacturer except foreign MasterCards.

Contactless payments with cards and compatible smartphones are well supported (Apple Pay and Google Pay).

When is customers' money paid into our bank account?

The money cashed in from customers can be made once you have entered all the bank details into your customer area.

The time to receive the money in his bank account is classic between 1 and 2 working days. You won't get all the money that customers receive because that's when Smile and Pay gets the degressive commission.

Our review of the Smile and Pay configuration

It is an entirely French solution. It is effective and works perfectly. It is a young company that has a bright future.

Both payment terminals are a bit expensive, but still efficient and efficient. Once they are well configured (and this is easy to do), you can make good use of them and cash in.

The process to set up Smile and Pay is simple. We regret the lack of support for foreign cards as can be the case.