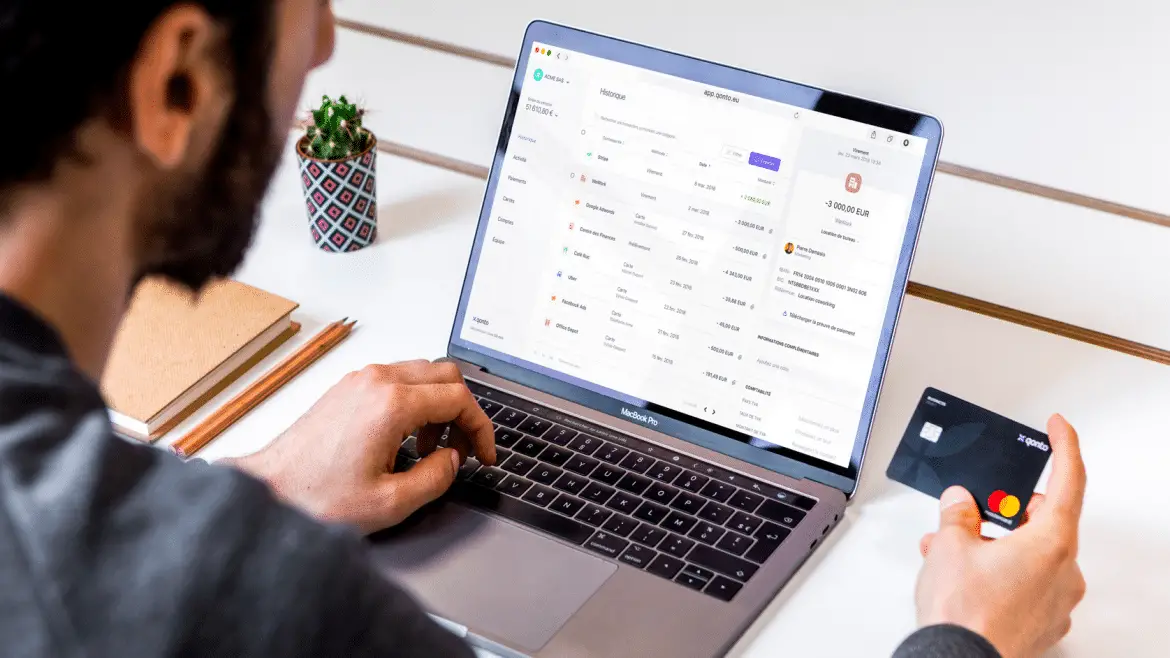

Qonto is a French online bank for professionals. It is a bank that differs from other structures thanks to the presence of its founders who seek to create a solution that can meet all French entrepreneurs.

Qonto's flagship features are multiple and we'll introduce them to you.

Qonto is a great online bank that has partnered with iZettle to enable its customers to benefit from a mobile payment terminal,cheap, and efficient.

Introducing Qonto, a 100% French online bank

One of Qonto's major strengths is certainly the possibility of hosting different legal structures. Indeed, micro-enterprises are well accepted, as are SAS, SASU, EURL, EIRL, SA, SCI, etc. This is a significant strength,because if a person opens his own business, he can stay at Qonto for a higher offer, without having to change banks. A monumental saving of time when we know the love for the paperwork of the French administrations.

The use of this online bank is simple. The mobile app, especially iOS (they have a majority of customers who own an iPhone and iPad), is very powerful.

Over the months, they add features that were, until now, reserved only for the web version. Entrepreneurs can manage their accountswith a masterful hand.

Several rates are available at Qonto. They are all expressed in Tax-Free:

- Freelance Solo: 9-HT/month,

- Standard Company: 29-HT/month,

- Premium company: 99-HT/month,

- Corporate company: 299-HT/month,

- Business creator Pack Solo (capital deposit and 12 months subscription to the Solo offer): 120 euros per year,

- Business creator Pack Standard (capital deposit and 12-month Standard subscription): 300 ht/year.

In each formula, you will be able to get additional information such as the number of physical cards, the number of virtual cards, insurance, access for the accountant to your bank account, so that he can do his job without you Disturb…

Another of Qonto's flagship features is certainly managing team expenses. Each member of a team can have personalized access. The manager can track the expenses of each card. It's a way to delegate while keeping a close eye on the smallest bank flows that take place on your professional bank account.

To help you with your follow-up, why not give a professional card to each person on your team? This way, you won't have any more expense notes to manage. Ask them to send you a photo of the proof of payment, directly from their Qonto interface, and you'll have it all.

To avoid a few abuses, you can limit the expenseof of each card.

As far as transfers are concerned, depending on the role and status, they may not be able to execute them. On the other hand, they can prepare them, so that you can then validate them.

A qonto-compatible payment terminal

Qonto is an online bank, so you can choose any mobile payment terminal. SumUp, Smile and Pay and iZettle are interesting solutions. MyPOS is excluded because it includes a bank account with a foreign IBAN.

On the other hand, Qonto has an interesting partnership with iZettle, which allows you to have a substantial discount. The purchase price of the TPE rises to 19 euros. It is a remarkable financial gesture.

The Swedish company was acquired by Paypal for $2.2 billion. It is one of the best on the payment terminal market.

Why iZettle?

SumUp and Smile and Pay are also good solutions and will suit your needs.

iZettle has the merit of offering a user experience friendly through its mobile application. This one is complete and more intuitive than the competition.

With the iZettle Reader 2, you can add a catalogue of products, cash in from the items, manage VAT directly on the product sheet, but also edit receipts by email or SMS for the customer.

All bank cards (credit and debit) are allowed. This is great news for foreign people who come to France and are looking for a TPE that accepts their card (American Express, Bancontact, iDEAL, JCB, China Union Pay, etc.).

Contactless payment is well included in this payment terminal. You can pay via the NFC chip in the card, but also through your smartphone, from Apple Pay and Google Pay.

The deadline to receive the money in his Qonto bank account is in the order of 2 to 3 working days. This is a classic term of a payment. However, there is no fee to pay your money into your account. You can set up a payment every day, every week or every month. It's up to you to choose the frequency that's right for you!

Qonto and iZettle is a partnership made to last. We can only recommend this alliance. Qonto is an online bank that meets the vast majority of business needs. And iZettle is a powerful, elegant and efficient TPE. What more could you ask for?